properties to a new private open-ended industrial fund for about C$210 million in cash and a roughly 25% retained stake in the unnamed vehicle. * Dream Industrial REIT agreed to sell 20 of its U.S. entered into a joint venture to acquire US$5 billion worth of single-family rental homes aimed at the middle-market demographic in the U.S.

to provide certain financing for the construction of Great Wolf Lodge resorts across the U.S. entered into a strategic arrangement with The Blackstone Group portfolio company Great Wolf Resorts Inc. sold a 49% interest in The News Building in New York City to South Korean investor Meritz Alternative Investment Management Co.

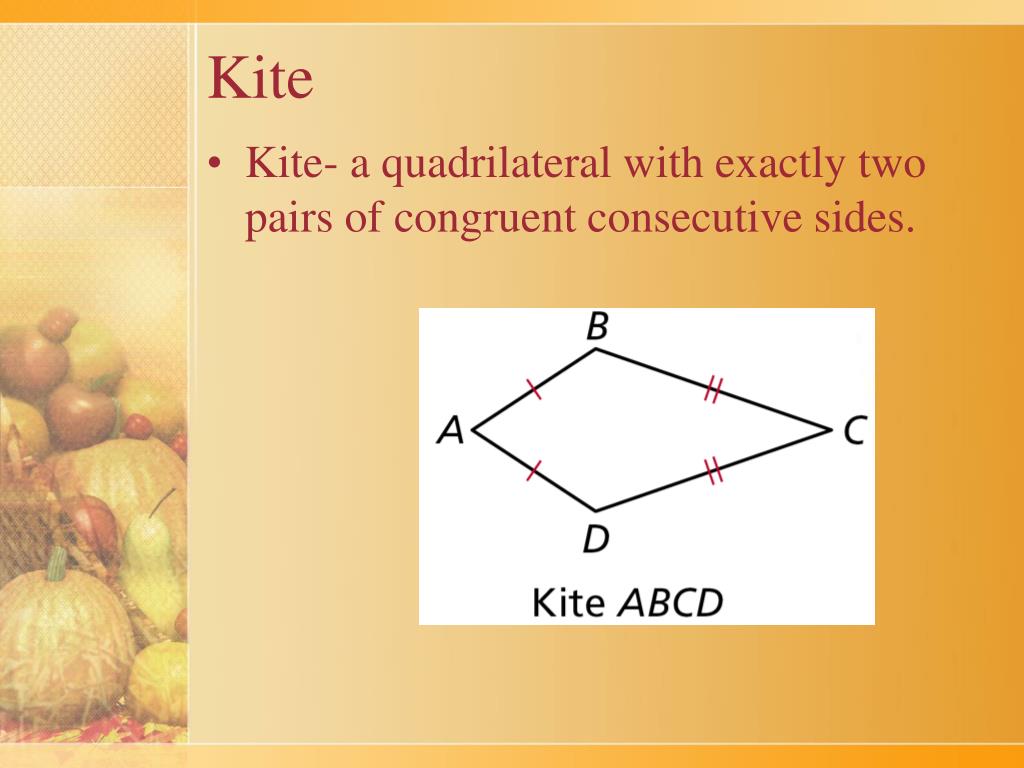

#Kite properties plus#

* Vornado Realty Trust agreed to buy the remaining 45% stake in the One Park Avenue office building in New York City from Canada Pension Plan Investment Board in a transaction that values the asset at $875 million for a total consideration of about $158 million in cash, plus Vornado's assumption of the Canadian pension fund's share of the existing debt. industrial portfolio held by Cabot Industrial Value Fund V LP, a fund managed by Cabot Properties Inc., Real Estate Alert reported. * The Blackstone Group reached a deal to buy an approximately 15 million-square-foot, $2.2 billion U.S. The go-shop period was provided under the company's merger agreement with The Blackstone Group Inc. did not get any alternative proposals from third parties it contacted during the go-shop period, which expired July 17. The Canadian asset manager owns an 8.35% stake in the German office landlord, which reportedly has a roughly €3.3 billion valuation. * Brookfield Asset Management is considering a potential bid to take alstria office REIT-AG private, Bloomberg News reported, citing people familiar with the matter. in a deal that is expected to be completed July 26. * The Ontario Superior Court of Justice approved Brookfield Property Partners LP's sale of its entire limited partnership units to Brookfield Asset Management Inc.

reaffirmed its support for its pending merger with Equity Commonwealth and rejected Starwood Capital Group's revised all-cash offer of $19.51 per share reduced by the termination fee owed to Equity Commonwealth of $62.2 million, or 63 cents per share, implying a net consideration of $18.88 per share. agreed to merge into a subsidiary of Kite Realty Group Trust to form a combined group expected to have an aggregate enterprise value of nearly $7.5 billion upon closing.

Vornado Realty Trust's consensus FFO per-share estimate for the second quarter is 72 cents per share, compared to $1.06 in the second quarter of 2020.įind out more in this week's chart watch. Office REITs, however, are forecast to report declining FFO per share. Shopping center REITs are expected to report high growth, at a median of 28.8%. is expected to report FFO of 2 cents per share, compared to negative 26 cents per share in the same period of 2020. Hotel REITs are forecast to lead the pack, as optimism about the sector's gradual recovery has remained strong since the start of the year. Hotel and shopping center real estate investment trusts are expected to report high year-over-year increases in funds from operations in their second-quarter earnings calls, according to S&P Global Market Intelligence estimates. S&P Global Market Intelligence offers our top picks of real estate news stories published throughout the week.

0 kommentar(er)

0 kommentar(er)